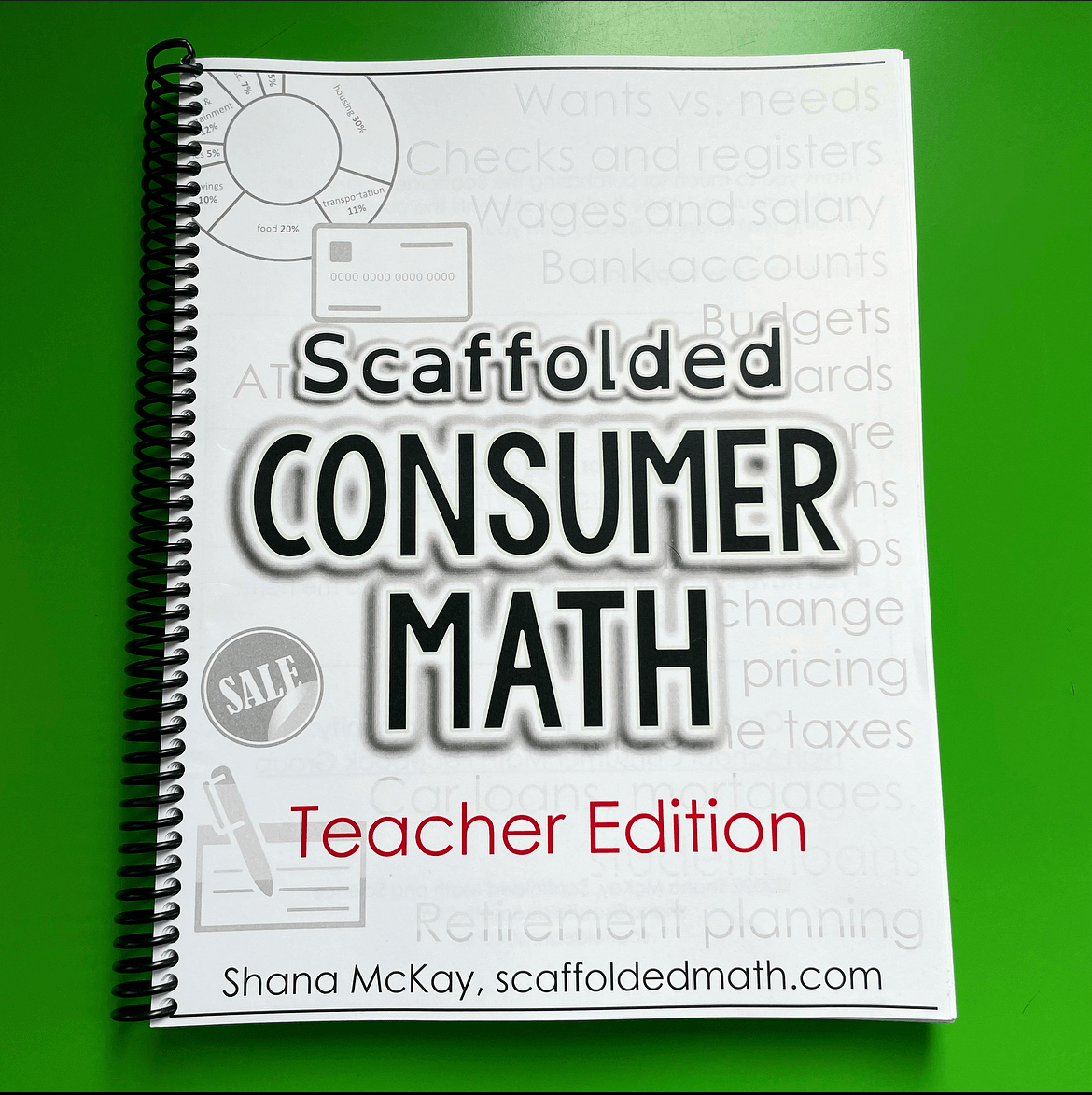

Scaffolded Consumer Math Curriculum

Scaffolded Consumer Math Curriculum

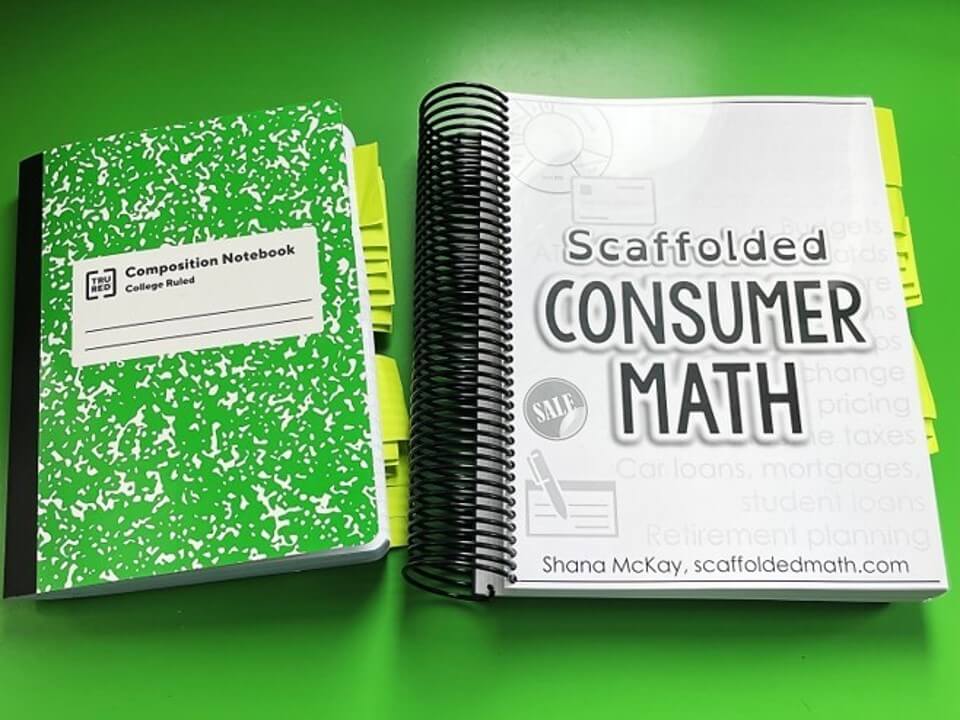

This comprehensive consumer math curriculum is an approachable guide to building financial literacy for teens. It includes everything you need to make the course easy to teach for you and enjoyable to learn for your students.

"Scaffolded Consumer Math curriculum was a real time-saver for me. From vocabulary words to prepared PowerPoints, student and teacher masters, and quizzes with keys, this set of materials allowed me to go over many basic financial skills and details with my students. I used the half page versions of student practice for my students to build their own notebooks. I loved the mix of guided notes, activities that I used with mini lessons and small group work, and practice options.” -Teacher Clara Maxcy

How do I file a tax return? What is a credit score? How much of my paycheck will be withheld for taxes? How do I calculate a budget? What's an APR? This printable consumer math curriculum answers all of these questions, and more!

The curriculum includes warm-ups, a student book, accompanying student notebook sheets for building an interactive notebook, a teacher's book, PowerPoint projector notes to shine on the board, editable quizzes for each unit and all answer keys.

Units:

- Wants vs. needs

- Checks and registers

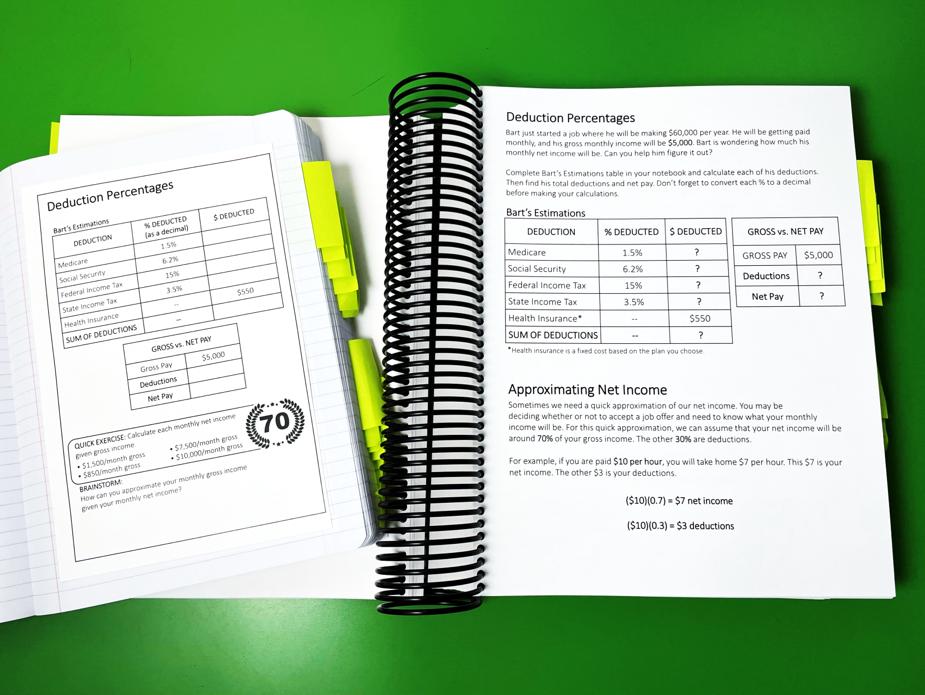

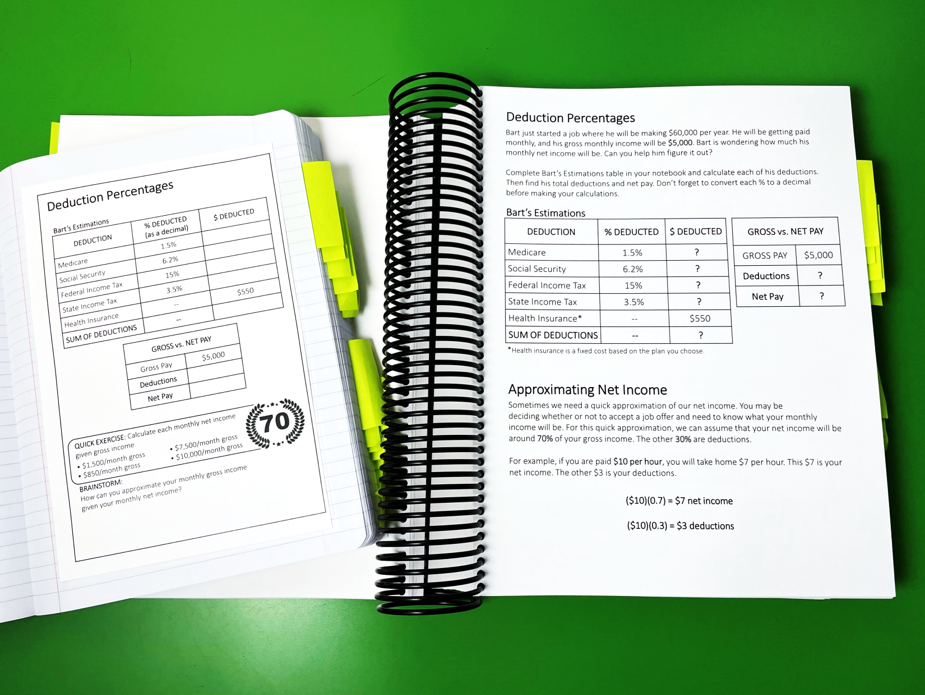

- Wages and salary

- Bank accounts

- Budgets

- Electronic banking and credit cards

- Credit score

- Discounts and coupons

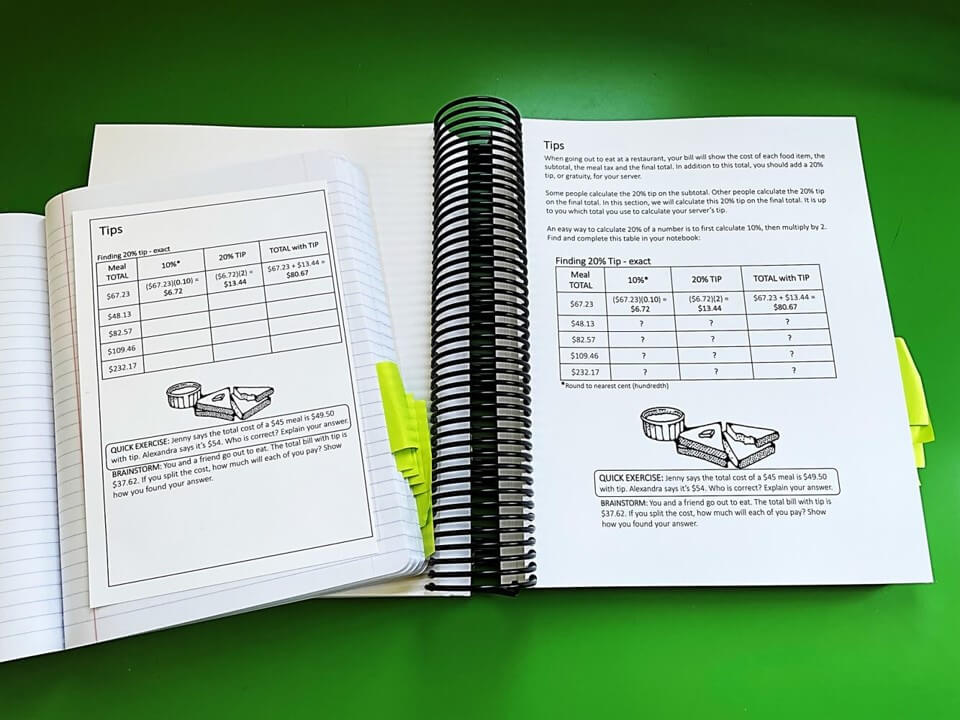

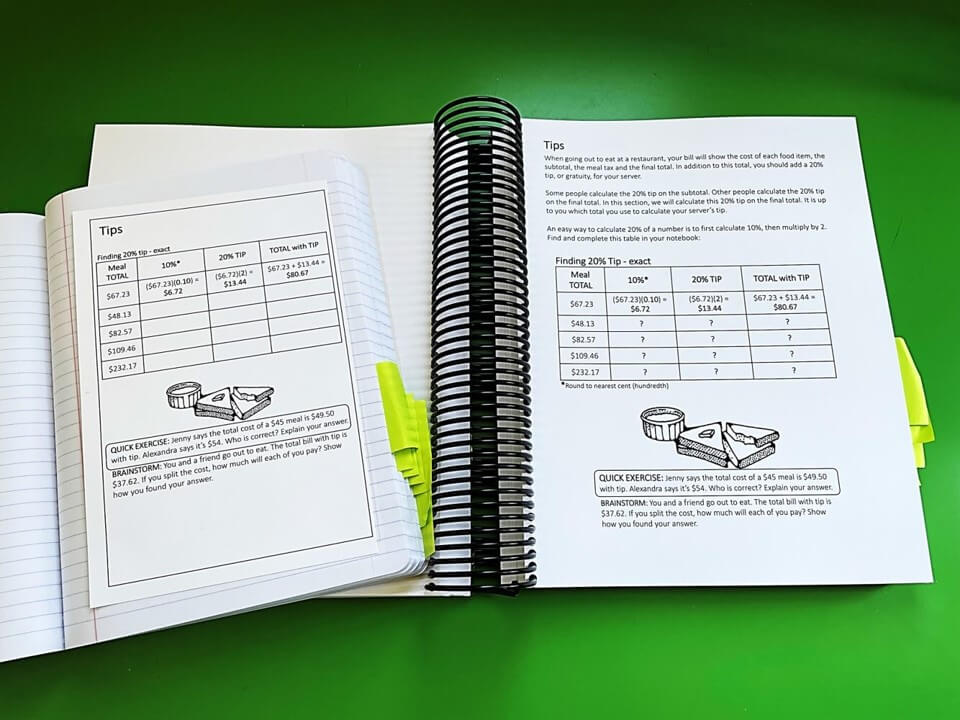

- Sales tax and tip

- Percent change

- Unit price

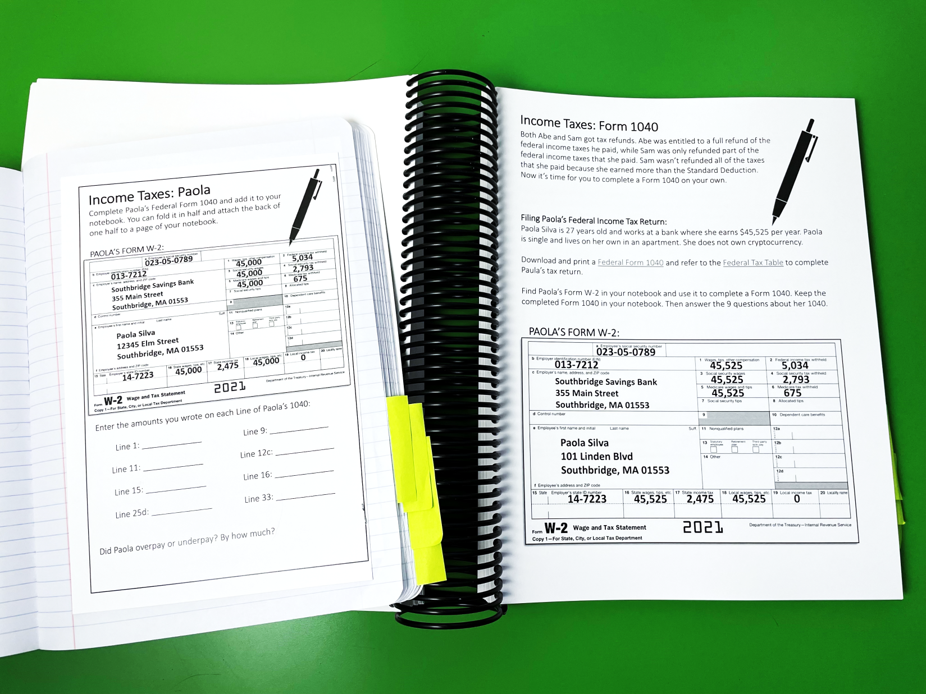

- Income taxes*

- Car loans

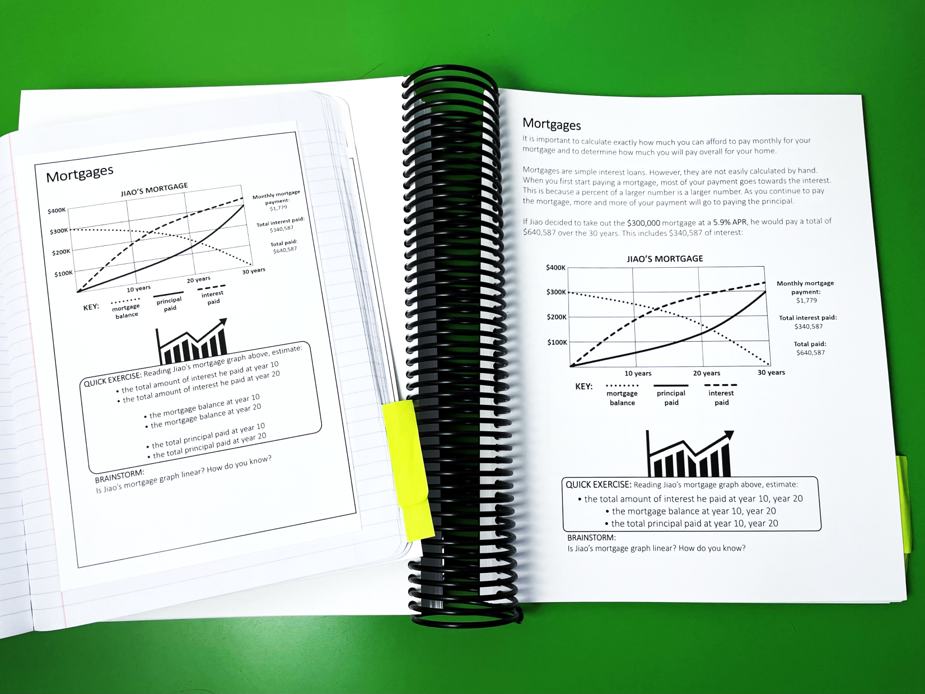

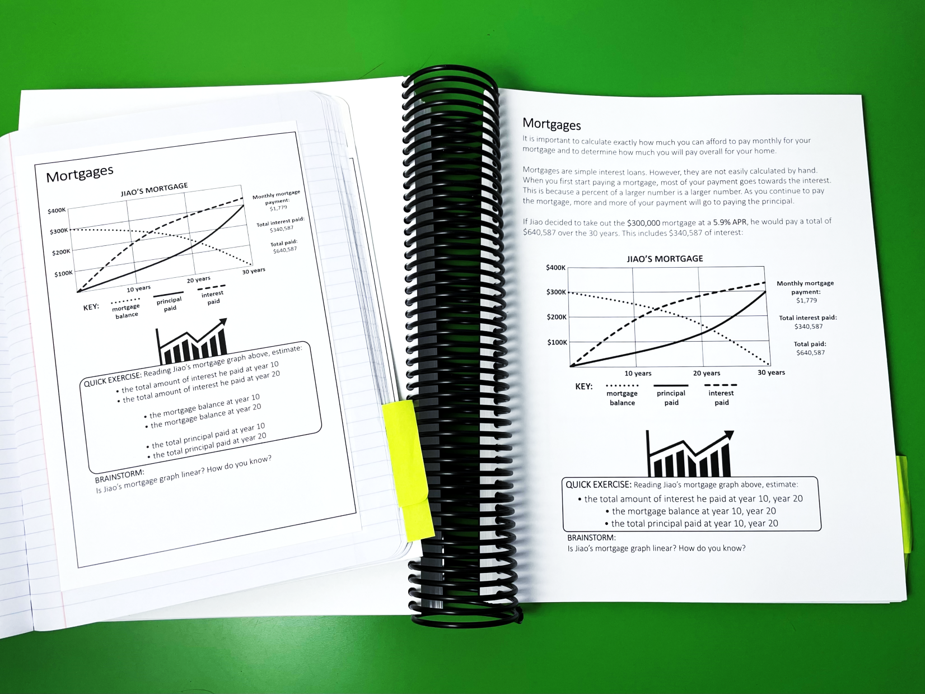

- Mortgages

- Student loans

- Investing

- Car insurance

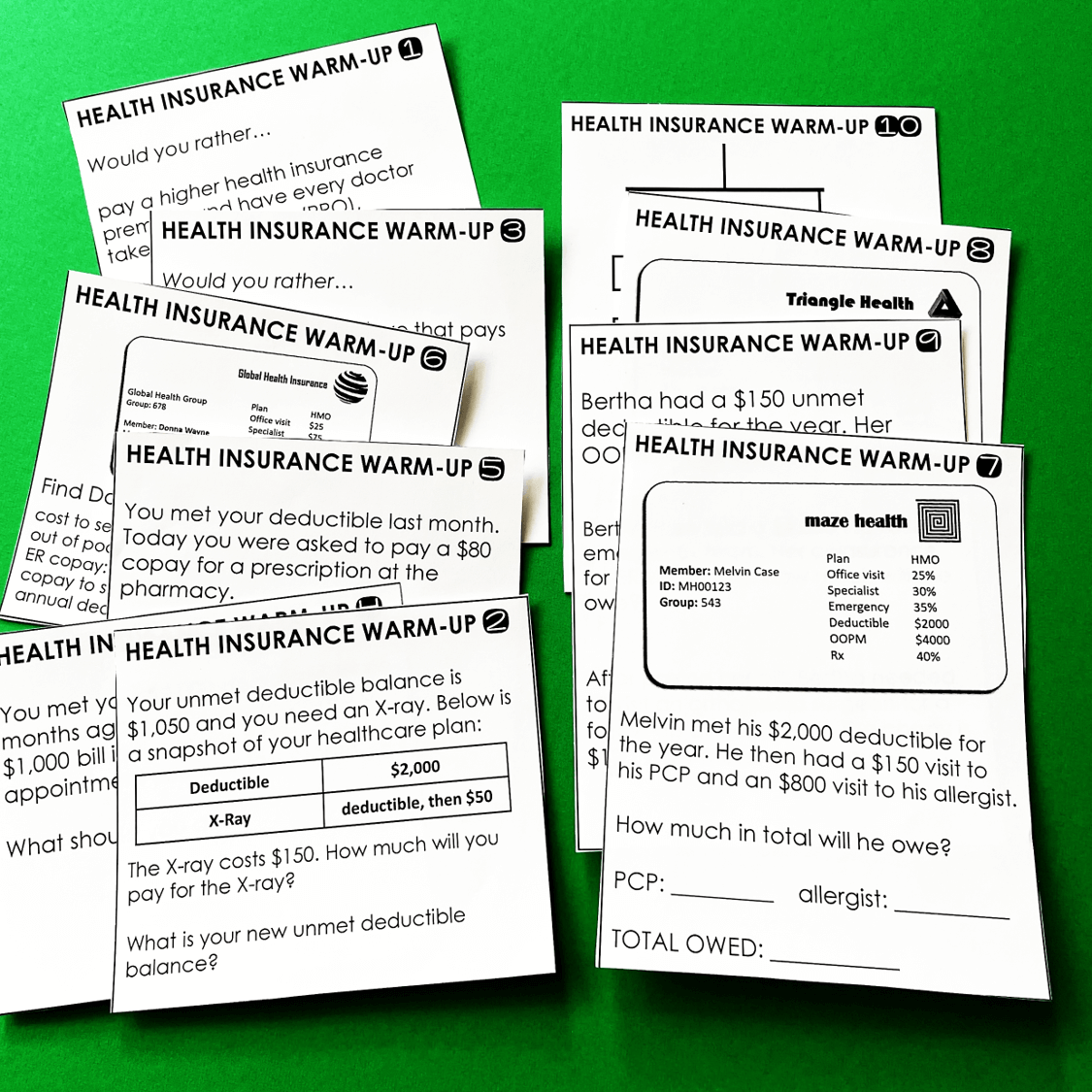

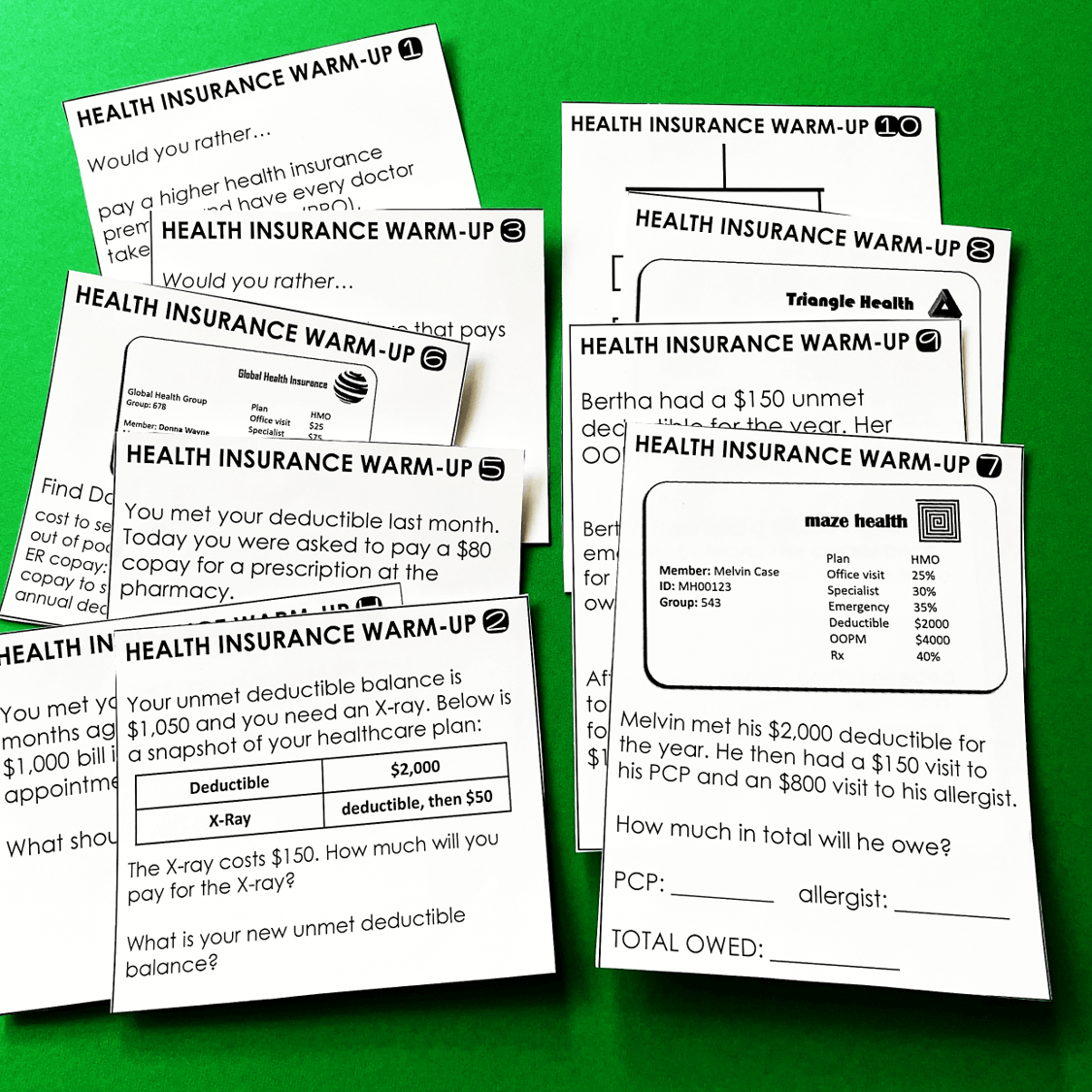

- Health insurance

*The income taxes unit is updated every year in January. Redownloads to get updates and additions are free.

Files included:

- Printable student book (199 pages)

- Printable teacher’s book (203 pages)

- Printable student notebook sheets (122 half-sheets)

- PowerPoint projector notes

- Editable quizzes for each unit (18 quizzes)

- Warm-ups for each unit

- All answer keys

Details:

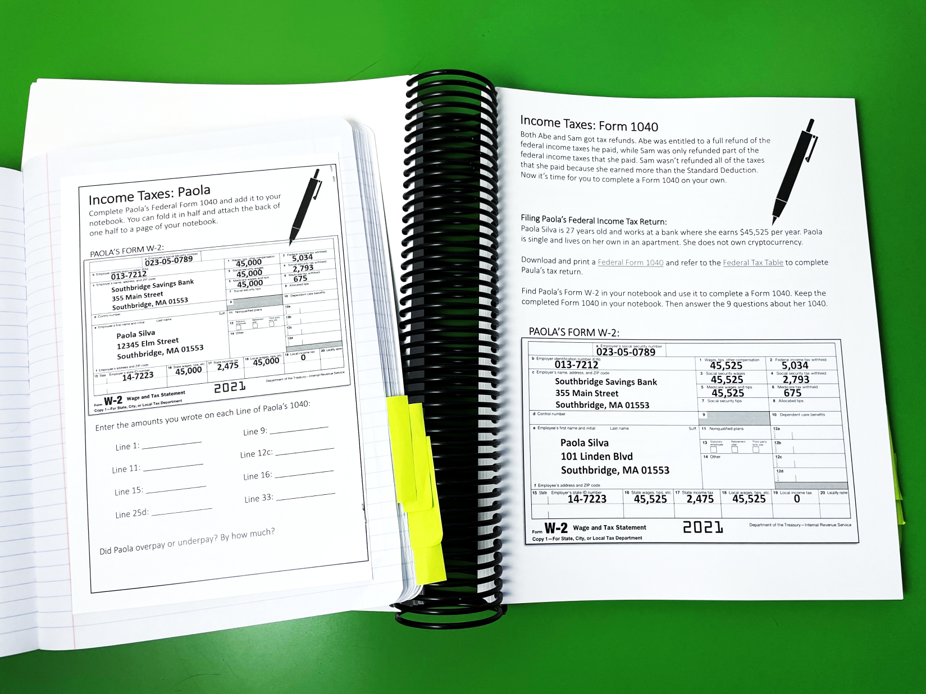

The student book is a reference that includes vocabulary, examples and questions for students to answer. You can choose to print the entire student book at once, or each unit at a time for student packets or their binders. Both formats are included.

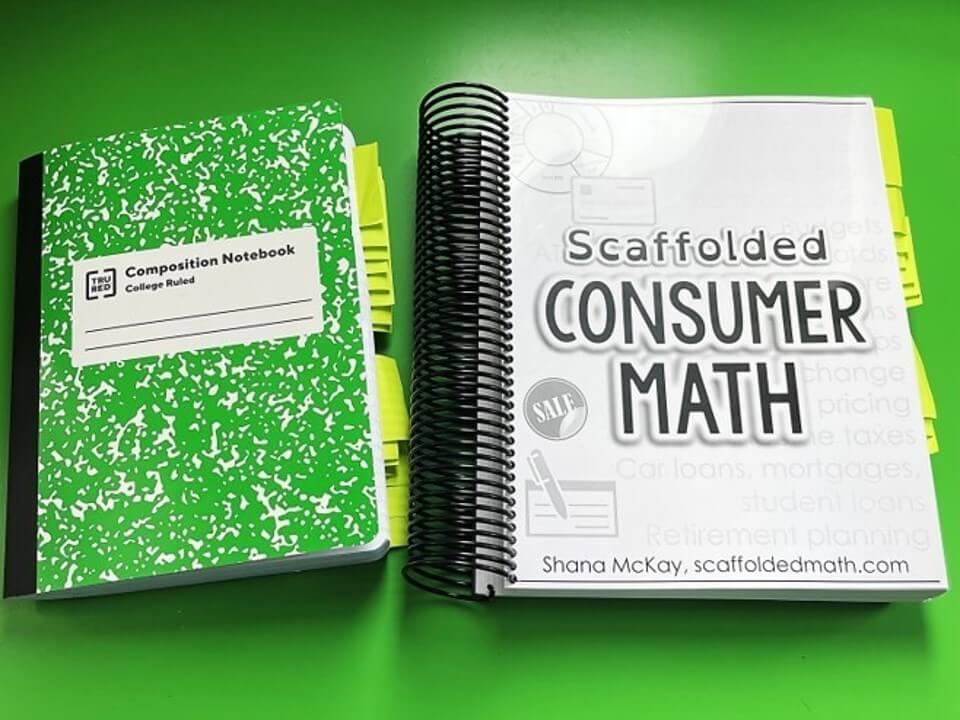

The student notebook sheets are half-sheets designed for an interactive notebook. The sheets provide space for students to answer the questions posed in the book, along with additional analysis questions. Students paste these notebook sheets into a composition notebook, which then becomes their own personal finance reference.

The teacher’s book and student notebook sheets answer key include all answers to all questions presented in the student book and the extra analysis questions on the student notebook sheets.

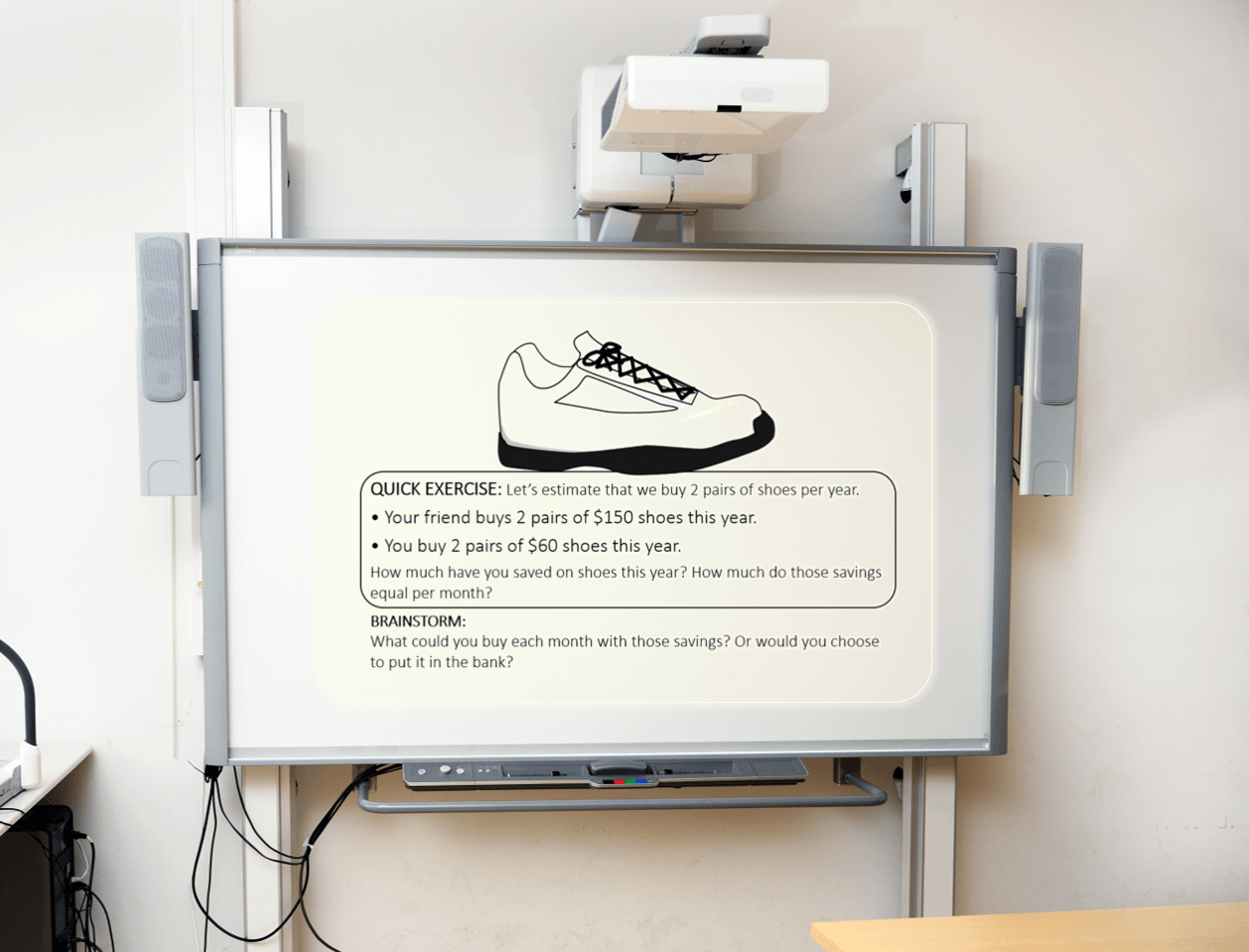

The PowerPoint notes match the student notebook sheets so that you can complete notes along with your students on the board if they require this additional support.

The quizzes are completely editable in PowerPoint and print as documents. Quiz answer keys are included for all quizzes and are also editable.

The warm-ups for every unit are formatted for student notebooks.

"I am so thankful for this well-assembled curriculum. It saved me time and helped me to enjoy teaching the class all year long. The students also mentioned the great learning during their senior exit interviews, too! Thank you so much for helping me to be great!" -Teacher Tyeisha Cox

Standards:

The curriculum covers the following National Standards for Personal Finance Education:

Earning Income: wages and salary, gross pay, exact net pay, approximating net pay, pay schedules, tips, earning interest, retirement savings, 401(K) employer matching, filing income taxes, tax deductions, wage theft, insurance

Spending: budgeting, keeping a register, comparing unit prices, sales tax, discounts, coupons

Saving: savings, checking, money market accounts, CDs, simple interest, compound interest, pre- and post-tax retirement accounts

Investing: risk vs. reward, stock market, bonds, retirement accounts, diversifying

Credit: credit card interest, credit card choices, credit score, credit report, minimum payments, APRs, down payments, car loans, mortgages, amortization schedules, student loan interest, student loan choices, deferment, forbearance, capitalizing interest

Who is the curriculum for?

I wrote this curriculum for high school students not taking precalculus their senior year. This is the group of students I taught and who I feel would best benefit from the curriculum.

I homeschool. Will this work for me?

Yes, homeschooling families are using the curriculum. All of the information needed to complete the student notebook sheets is found in the student book. You may not need the projector notes because they are meant to project in a classroom, but everything else will work.

Is is available on TPT?

No, the curriculum is only available here on my website.

Do you have a sample to share?

While I don't have a sample to share, you can download a detailed preview of the curriculum here.

Do you have a printout for my admin for approval?

Yes, you can find a printout here for your administrator.

Updates:

This curriculum will be updated every year in January to reflect changes to the way we file income taxes. Additional units and supplemental materials may also be added. Redownloads to get updates and additions are always free.

Purchase orders:

Purchase order information can be found here.

Please send an email to shana@scaffoldedmath.com if you have any questions. There is also a Facebook group for Consumer Math teachers here.

Couldn't load pickup availability