Collection: Consumer Math

Ready-to-use consumer math lessons and activities designed to make personal finance easy to teach, fun to learn, and highly engaging for students.

-

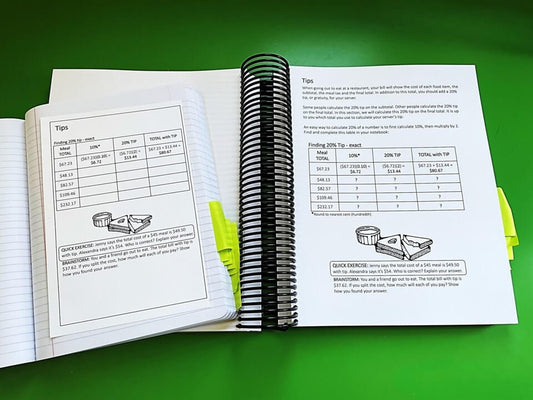

Scaffolded Consumer Math Curriculum

37 reviewsRegular price $100.00Regular priceUnit price / per -

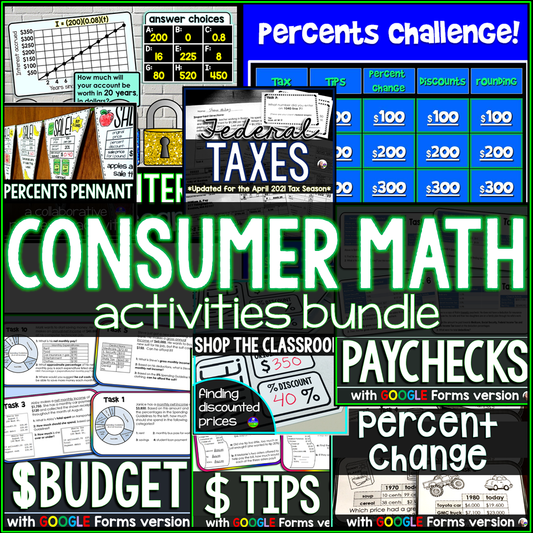

Consumer Math Activities Bundle

445 reviewsRegular price $34.00Regular priceUnit price / per -

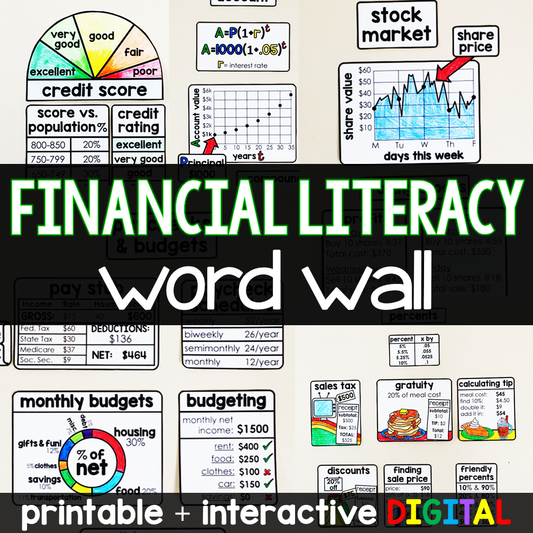

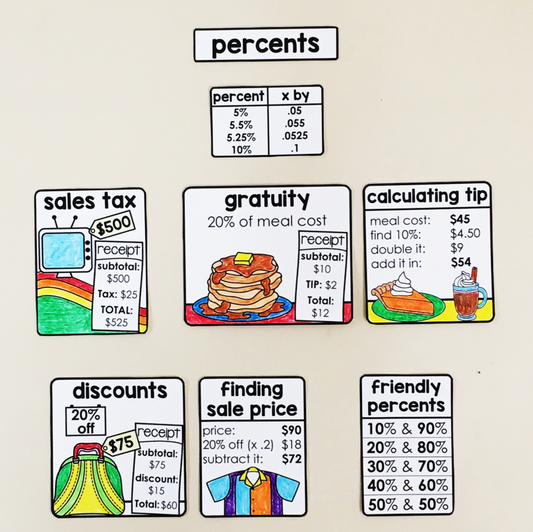

Financial Literacy Vocabulary Word Wall | Consumer Math | Personal Finance

159 reviewsRegular price $12.00Regular priceUnit price / per -

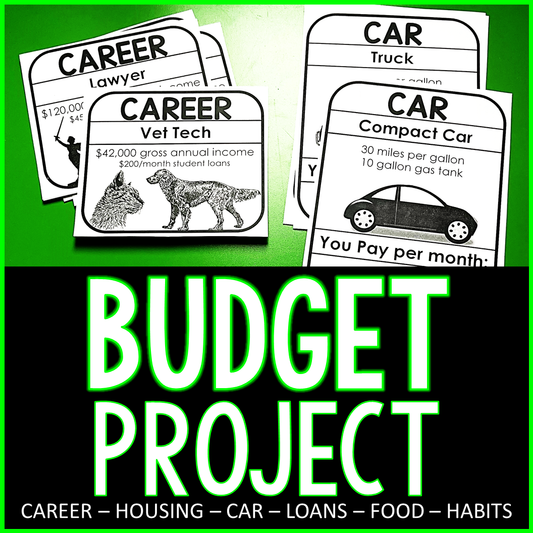

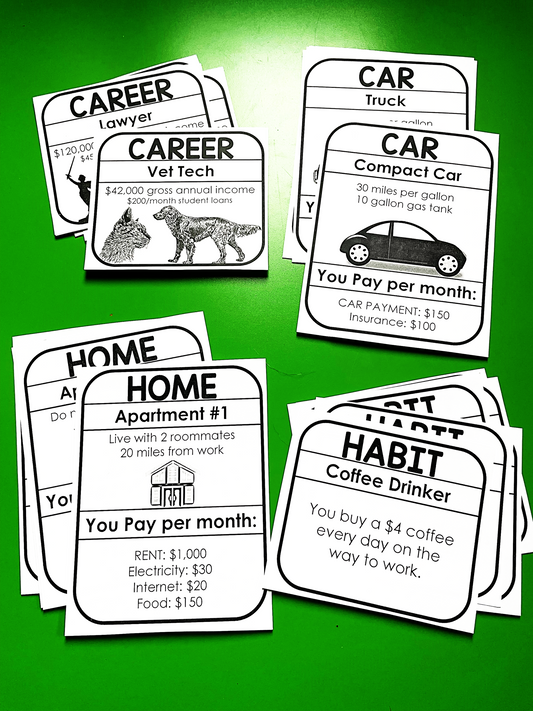

Budget Project

44 reviewsRegular price $3.00Regular priceUnit price / per -

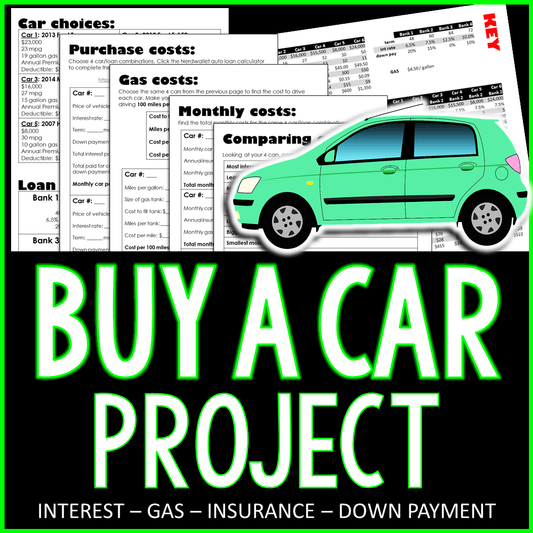

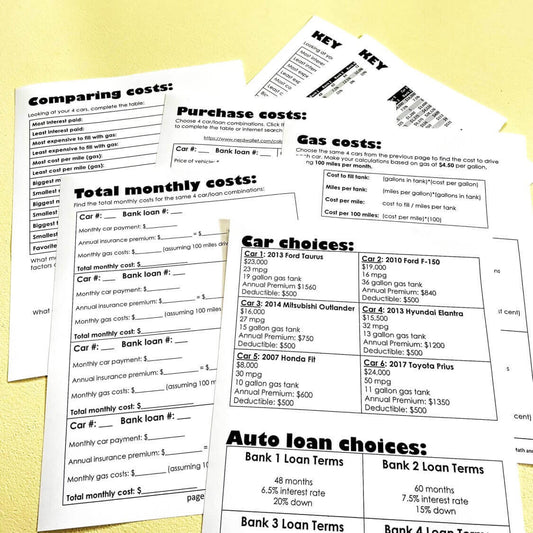

Buy a Car Project

35 reviewsRegular price $3.00Regular priceUnit price / per -

Filing Income Tax Task Cards - Federal Income Taxes 1040 Activity

218 reviewsRegular price $3.50Regular priceUnit price / per -

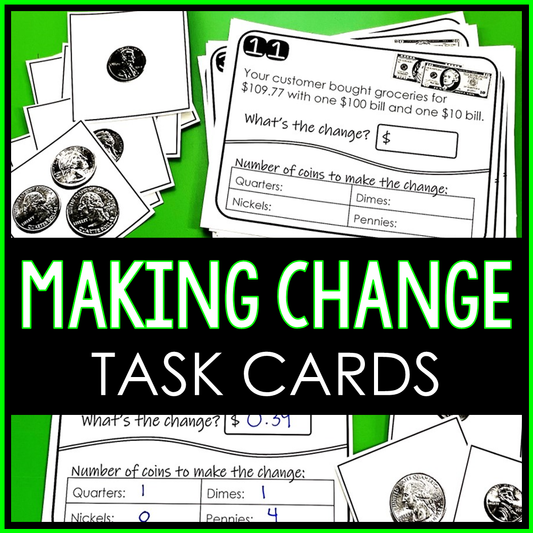

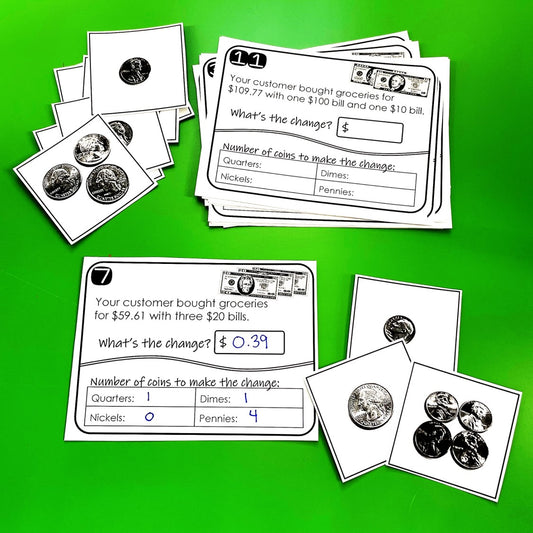

Making Change, Counting Money Task Cards Activity

10 reviewsRegular price $3.00Regular priceUnit price / per -

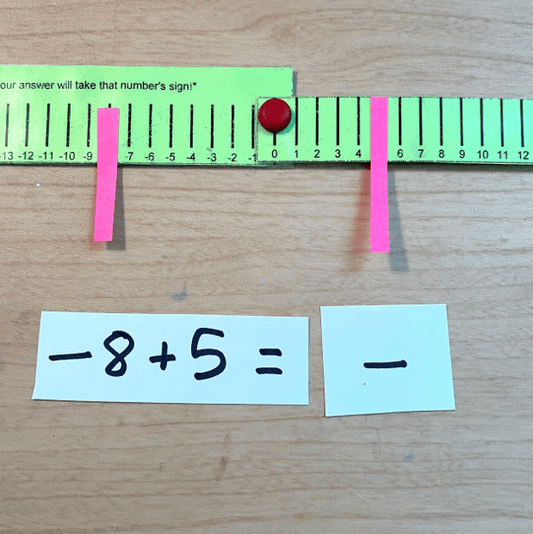

Integer Operations Manipulative

511 reviewsRegular price $4.00Regular priceUnit price / per -

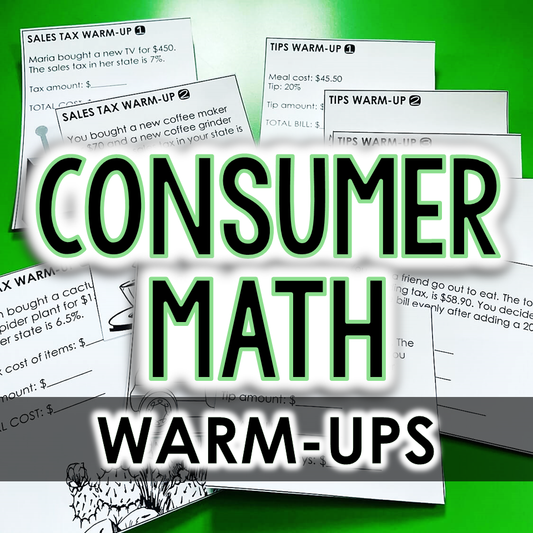

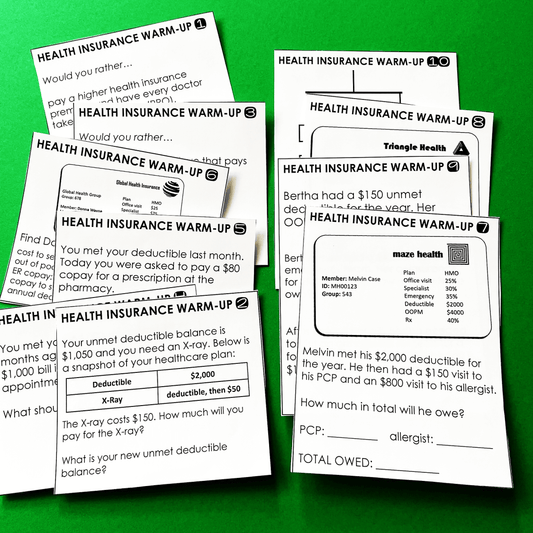

Consumer Math Warm-Ups 18 Units of Financial Literacy Bell Ringers

3 reviewsRegular price $7.00Regular priceUnit price / per -

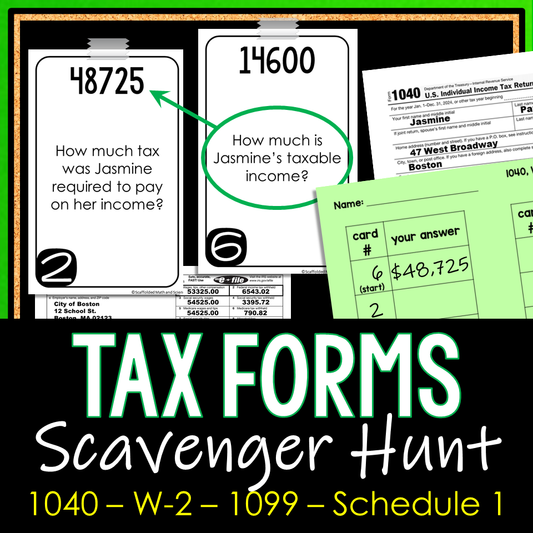

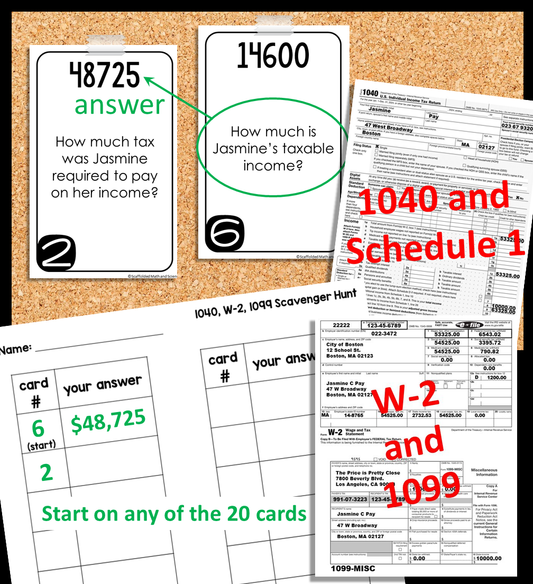

Tax Forms 1040, W-2, 1099, Schedule 1 Consumer Math Scavenger Hunt Activity

No reviewsRegular price $3.00Regular priceUnit price / per -

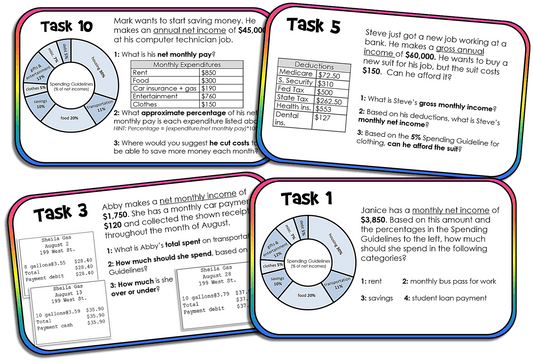

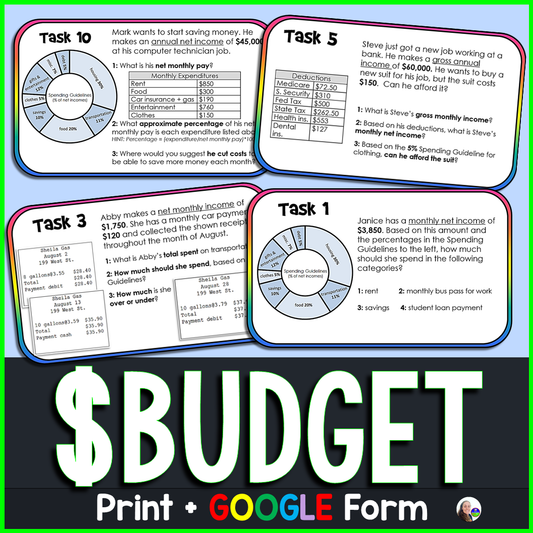

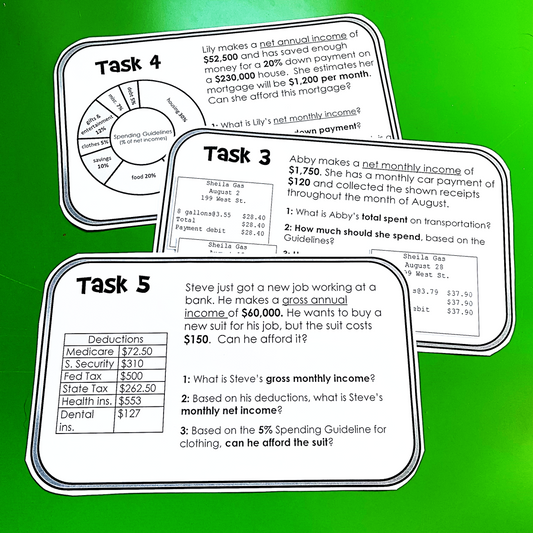

Budget Task Cards Personal Finance Budgeting Activity

224 reviewsRegular price $3.00Regular priceUnit price / per -

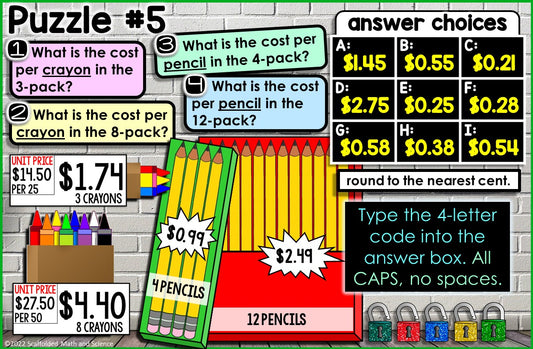

Unit Price Digital Math Escape Room

10 reviewsRegular price $3.00Regular priceUnit price / per -

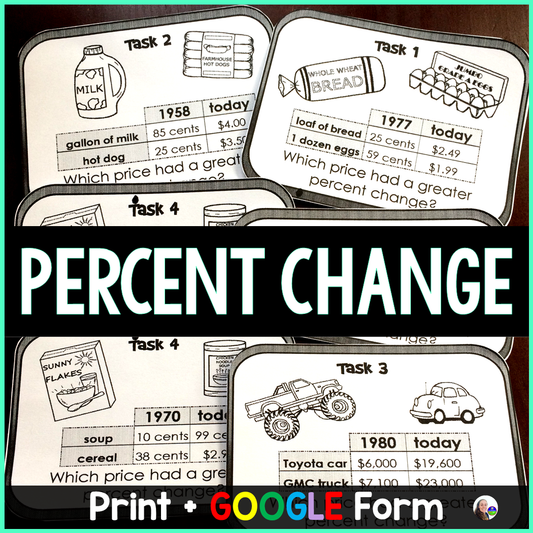

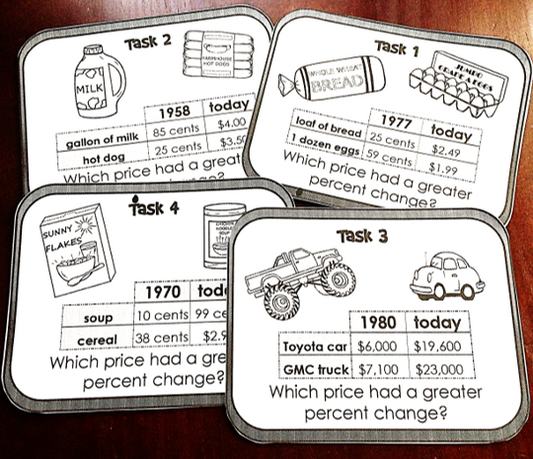

Percent of Change Task Cards Activity

197 reviewsRegular price $3.00Regular priceUnit price / per -

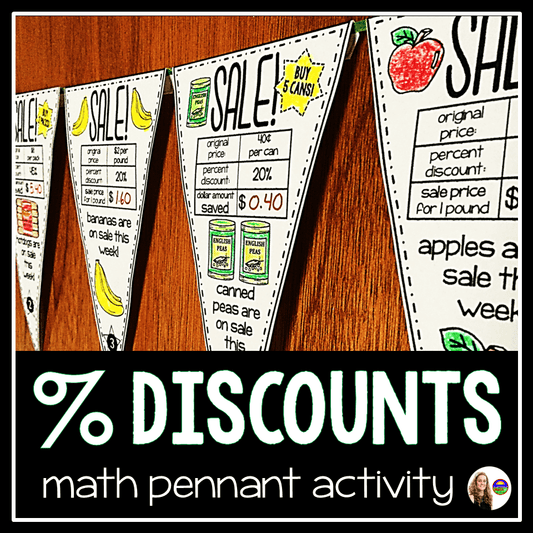

Percent Discounts Grocery Shopping Math Pennant Activity

176 reviewsRegular price $3.00Regular priceUnit price / per -

Percent Sales Tax, Tip, Discount Digital Math Escape Room

No reviewsRegular price $3.00Regular priceUnit price / per -

Rounding Money to the Nearest Cent/Hundredths Task Cards Activity

No reviewsRegular price $1.00Regular priceUnit price / per$2.00Sale price $1.00Sale -

Calculating Markup and Markdown Percentages Coloring Worksheet

No reviewsRegular price $1.00Regular priceUnit price / per -

"2 Truths and a Lie" Paycheck Deductions Net & Gross Pay Error Analysis Activity

No reviewsRegular price $1.50Regular priceUnit price / per -

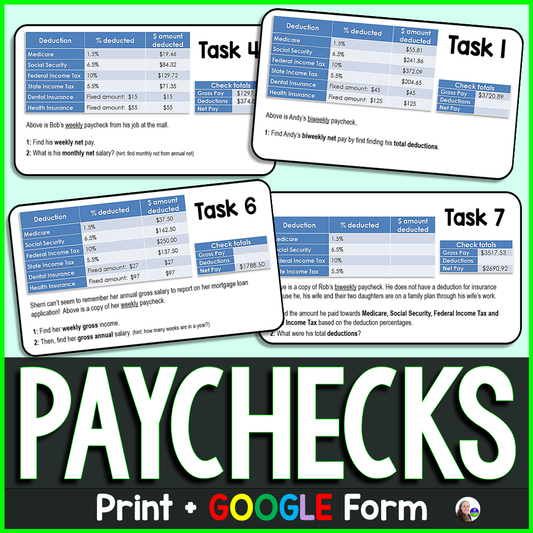

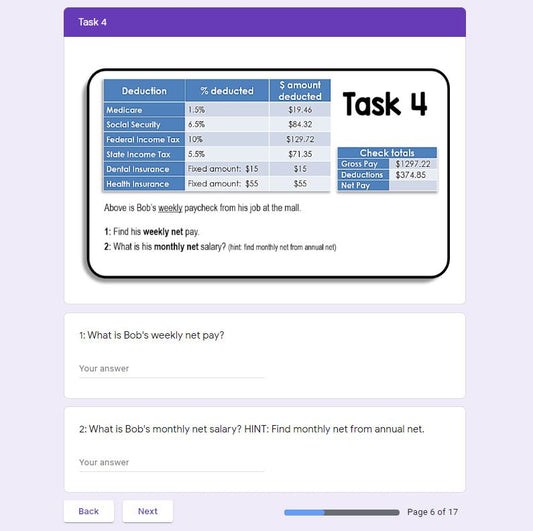

Paycheck Task Cards Financial Literacy Activity

95 reviewsRegular price $3.00Regular priceUnit price / per